Oghma Capital's service strategy

Client

Oghma Capital, a credit solutions specialist for individuals and businesses (Home Equity, Auto Equity, Construction Loans). Acts as Banking Correspondent structuring exclusive proposals beyond traditional banks.

Role

Founding Design Consultant

Team

add

4 Co-Founder & Credit Specialists

add

4 Co-Founder & Credit Specialists

add

Content Specialist

add

Content Specialist

add

Marketing Manager

add

Marketing Manager

add

Senior Full-Stack Developer

add

Senior Full-Stack Developer

Challenge

•

Need to scale personalized credit service while maintaining "digital in process, human in essence" positioning

•

Need to scale personalized credit service while maintaining "digital in process, human in essence" positioning

•

Fragmented manual process across multiple touchpoints

•

Fragmented manual process across multiple touchpoints

•

No integration between tools, inconsistent customer experience

•

No integration between tools, inconsistent customer experience

•

Lack of visibility into conversion funnel gaps

•

Lack of visibility into conversion funnel gaps

Key actions

•

Mapped complete customer journey from awareness to closed deal

•

Mapped complete customer journey from awareness to closed deal

•

Designed seamless touchpoints

•

Designed seamless touchpoints

•

Implemented AI orchestration

•

Implemented AI orchestration

Impact

check

Contributed to +R$ 164M in operations volume, +7,680 clients served, +670 contracts closed

check

Contributed to +R$ 164M in operations volume, +7,680 clients served, +670 contracts closed

check

100% online process with average approval time of 10-15 days (competitive for credit sector)

check

100% online process with average approval time of 10-15 days (competitive for credit sector)

check

Positioned for Marco Legal das Garantias (Law 14.711/23): Service blueprint implemented before July 2025 regulatory change allowing multiple loans on same property, enabling competitive advantage during market expansion

check

The launch introduced a new SaaS model for Greiner, with subscription plans ranging from BRL 200 to BRL 990 per month 2022

check

Positioned for Marco Legal das Garantias (Law 14.711/23): Service blueprint implemented before July 2025 regulatory change allowing multiple loans on same property, enabling competitive advantage during market expansion

check

Automated orchestration eliminated manual handoffs while preserving human touchpoints at critical moments

check

Automated orchestration eliminated manual handoffs while preserving human touchpoints at critical moments

check

Scalable service architecture enabling growth without proportional team expansion

check

Scalable service architecture enabling growth without proportional team expansion

More featured cases

More featured cases

More cases that illustrate how I systematize and deliver a cohesive experience across every touchpoint

More cases that illustrate how I systematize and deliver a cohesive experience across every touchpoint

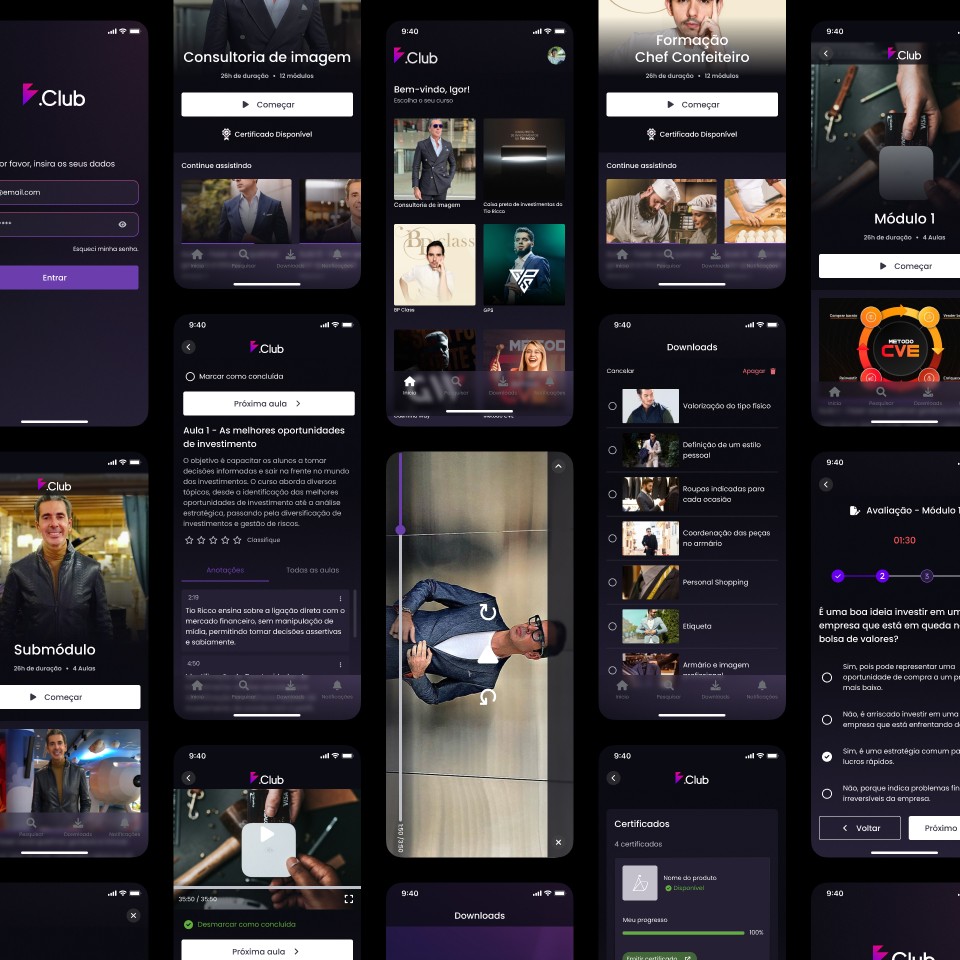

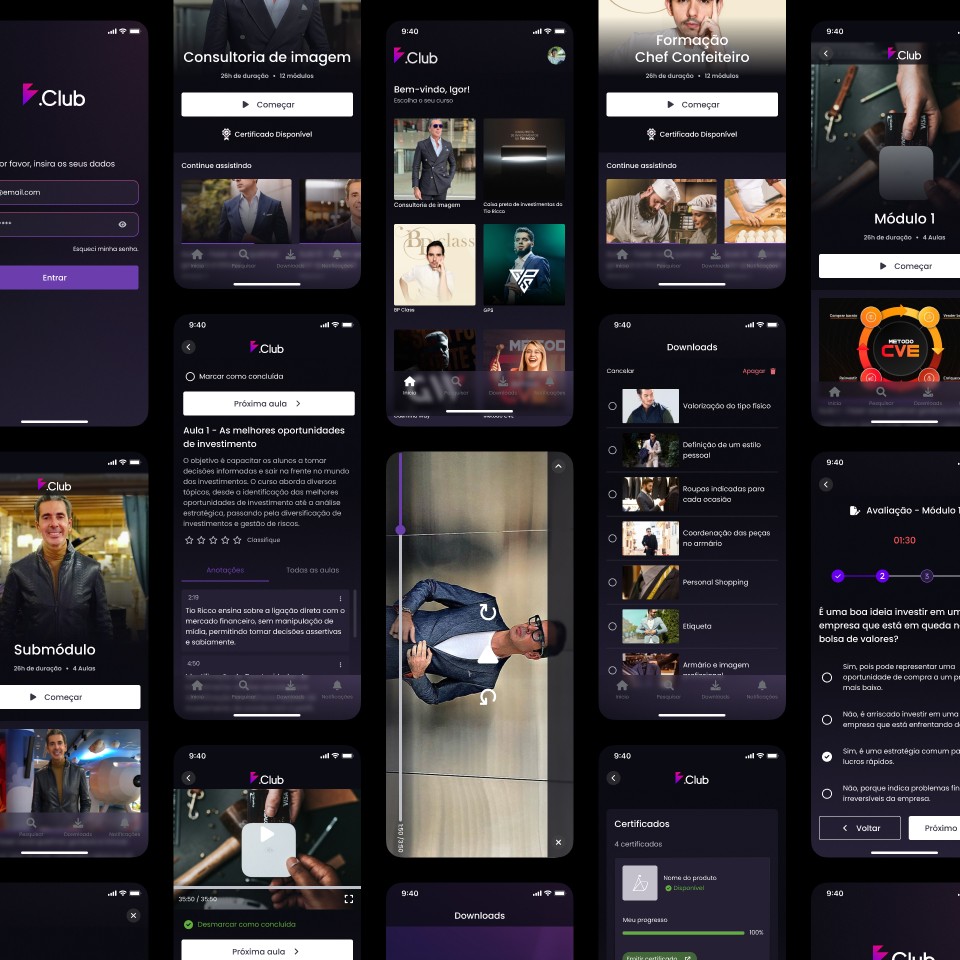

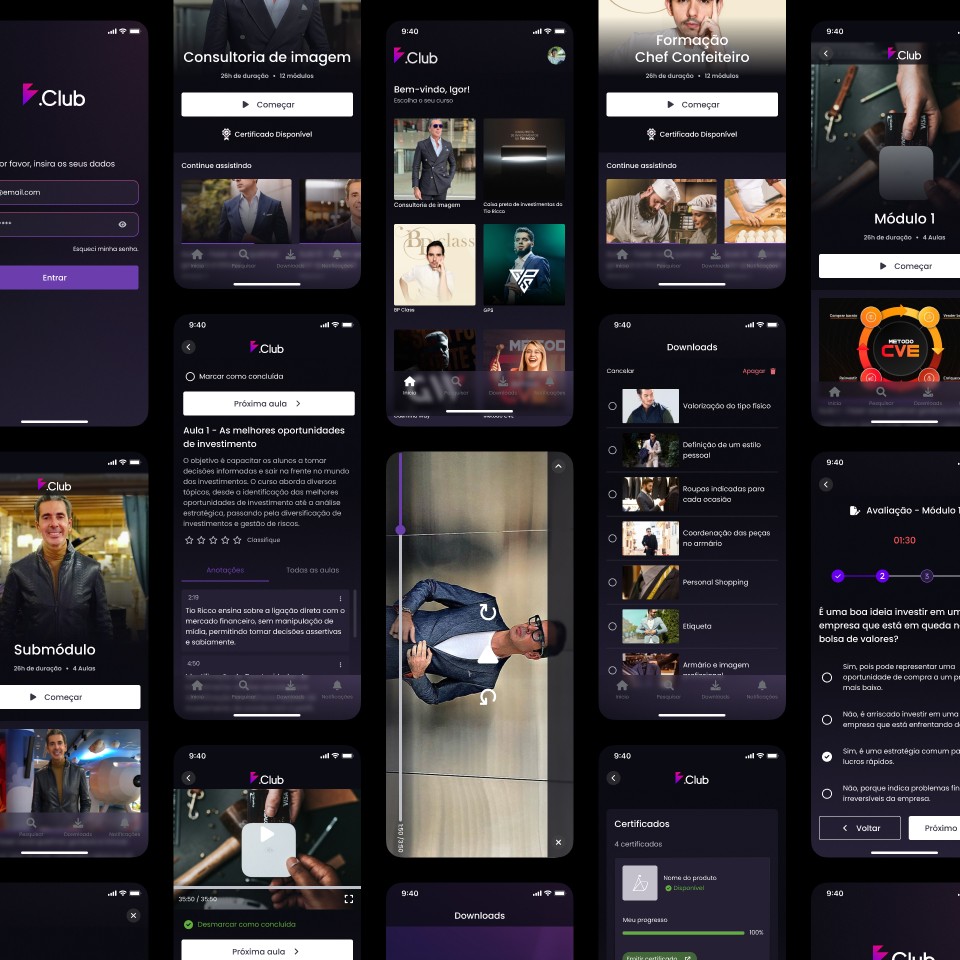

TMB ecosystem

FinTech

+104% revenue growth · 400K activated students · First mobile banking app for infoproducers

See case

Greiner Bio-One eTrack

HealthTech

90% traceability and pre-analytical error reduction · Expanding to 4 language markets · Redesign of pioneering product

See case

Blitzpay ecosystem

EdTech & FinTech

Millions transacted · 30% faster design-dev operations · NPS 8+

See case

TMB ecosystem

FinTech

+104% revenue growth · 400K activated students · First mobile banking app for infoproducers

See case

Greiner Bio-One eTrack

HealthTech

90% traceability and pre-analytical error reduction · Expanding to 4 language markets · Redesign of pioneering product

See case

Blitzpay ecosystem

EdTech & FinTech

Millions transacted · 30% faster design-dev operations · NPS 8+

See case

TMB ecosystem

FinTech

+104% revenue growth · 400K activated students · First mobile banking app for infoproducers

See case

Greiner Bio-One eTrack

HealthTech

90% traceability and pre-analytical error reduction · Expanding to 4 language markets · Redesign of pioneering product

See case

Blitzpay ecosystem

EdTech & FinTech

Millions transacted · 30% faster design-dev operations · NPS 8+

See case

© Stephan Oliveira, 2026

stephan.oliveira.design@gmail.com

© Stephan Oliveira, 2026

stephan.oliveira.design@gmail.com

© Stephan Oliveira, 2026

stephan.oliveira.design@gmail.com